AI and Data Nuclearization: Is bigger better?

Can Large scale nuclear Reactors take the lead? Small Modular Reactors: Still Too Expensive, Too Slow, and Too Risky, Nuclear Power Hungry Google, Will Thailand go nuclear?

Large Reactors to the Lead?

Small Modular Reactors Advance Nuclear Power Expansion

By IAEA

Scaling up nuclear power to the level needed to achieve net zero is a significant and multifaceted undertaking, and while many reactor types may play a role, large reactors are set to lead the way. Large water cooled reactors were central to the rise of the nuclear industry in the 20th century, and the advanced reactors planned or under construction today, many of which are in the 1–1.7 gigawatts (electrical) (GW(e)) range, are poised to provide the bulk of new nuclear capacity.

“For countries already operating nuclear power plants, large light water reactors, rather than small modular reactors (SMRs), will drive the increase in nuclear capacity,” says Aline des Cloizeaux, Director of the IAEA’s Division of Nuclear Power. “Large reactors are a proven technology that can economically provide a large and reliable baseload of energy. But we do expect countries and industries to tap into the potential of SMRs as well.”

Nuclear power must be expanded to meet the world’s net zero goals — that was the clarion call issued by IAEA Director General Rafael Mariano Grossi last December at the 28th session of the Conference of the Parties to the United Nations Framework Convention on Climate Change (COP28), in a statement supported by dozens of countries. This position was affirmed by the inclusion of nuclear power in the Global Stocktake for the first time in the Conference’s almost 30-year history.

In a high case scenario, the IAEA’s projection is that nuclear energy capacity will more than double by 2050, from 371 GW(e) in 2022 to 890 GW(e) by 2050, with only around 10% of this increase expected to come from SMR deployments. Hitting this mark means adding at least 20 GW(e) per year. “The high case projection is ambitious but technically feasible,” says Henri Paillere, Head of the IAEA’s Planning and Economic Studies Section.

Smaller reactors like SMRs and microreactors may be particularly suitable for providing power to industrial end users and remote communities with smaller electric grids, and for powering non-electric applications such as hydrogen production and seawater desalination. However, SMRs will need demonstration before their broader deployment; larger reactors will continue to dominate the nuclear power landscape in the years to come.

Almost all of the 58 nuclear reactors currently under construction are large reactors, and expansion plans in nuclear power operating countries and newcomer countries alike are mostly centred around reactors with 1 GW or more of capacity, although many of these countries are eyeing eventual SMR deployment as well. Poland, a newcomer aiming to add nuclear by the mid-2030s, plans to deploy 6–9 GW(e) of generating capacity with large nuclear power reactors. China, which currently operates 55 reactors, expects to expand its nuclear power capacity eightfold to around 400 GW by 2060, mainly through the deployment of large reactors.

Challenges to nuclear expansion

According to Paillere, the biggest challenges in expanding nuclear energy capacity are those related to financial and human resources: “Mechanisms are needed to attract capital from investors and the private sector to fund new nuclear projects. There is enough money to fund investments for the clean energy transition. What is making investors cautious of nuclear power is the risk, like delays in construction”.

After a hiatus of decades in nuclear new builds, the construction of large, first-of-a-kind nuclear projects in Western countries has often been plagued by cost overruns and delays, as skills are relearned and processes revitalized. “There had not been construction in 20 years in some of those countries. Human resources needed to be trained and supply chains rebuilt,” says Paillere. “Increasing nuclear capacity means increasing construction and grid connections, which means finding more engineers, technicians, welders and more. The issue of human resources is not specific to nuclear, but it is a common challenge across clean energy technologies”. Lessons learned from previous projects, including in project management and stakeholder engagement, will be critical to the timely completion of new build endeavours.

In some countries, such as Belarus, China, the Republic of Korea, the Russian Federation and the United Arab Emirates, new build projects — most of which entail the construction of advanced water cooled reactors — have proceeded largely on time and on budget. “The standardized design of advanced reactors expedites licensing and reduces both capital costs and construction time,” says des Cloizeaux.

Past and future expansion

The 1970s saw a boom in nuclear power expansion, driven mainly by North America and Europe. In 1970, 15 countries operated 90 nuclear power reactors with a total capacity of 16.5 GW(e). Throughout the 1970s, construction started on 25–30 new nuclear units annually. By 1980, 22 countries operated 253 nuclear power reactors with 135 GW(e) of capacity. By the end of 1990, nuclear capacity had more than doubled to 326 GW(e) worldwide.

“The nuclear industry and supply chain were well established and able to build 30 GW per year,” Paillere says. “This is encouraging because, at that time, there were only a few countries leading the trend, such as France, Japan and the United States of America. Today, China and the Russian Federation have become major players and have the supply chain and industry to support the expansion of nuclear power”.

A revival and expansion of nuclear power to achieve global goals, whether through large reactors or SMRs, will require policy support and tight cost controls. “The momentum to realise the goals is there, but it will take more political action,” says des Cloizeaux.

https://www.iaea.org/bulletin/large-reactors-poised-to-lead-the-nuclear-power-expansion-as-small-modular-reactors-advance

Small modular nuclear reactors get a reality check in new report

Deploying small modular nuclear reactors

Source: GE Hitachi

A new report has assessed the feasibility of deploying small modular nuclear reactors to meet increasing energy demands around the world. The findings don't look so good for this particular form of energy production.

Small modular nuclear reactors (SMR) are generally defined as nuclear plants that have capacity that tops out at about 300 megawatts, enough to run about 30,000 US homes. According to the Institute for Energy Economics and Financial Analysis (IEEFA), which prepared the report, there are about 80 SMR concepts currently in various stages of development around the world.

While such reactors were once thought to be a solution to the complexity, security risks, and costs of large-scale reactors, the report asks if continuing to pursue these smaller nuclear power plants is a worthwhile endeavor in terms of meeting the demand for more and more energy around the globe.

The answer to this question is pretty much found in the report's title: "Small Modular Reactors: Still Too Expensive, Too Slow, and Too Risky."

If that's not clear enough though, the report's executive summary certainly gets to the heart of their findings.

"The rhetoric from small modular reactor (SMR) advocates is loud and persistent: This time will be different because the cost overruns and schedule delays that have plagued large reactor construction projects will not be repeated with the new designs," says the report. "But the few SMRs that have been built (or have been started) paint a different picture – one that looks startlingly similar to the past. Significant construction delays are still the norm and costs have continued to climb."

Too Expensive

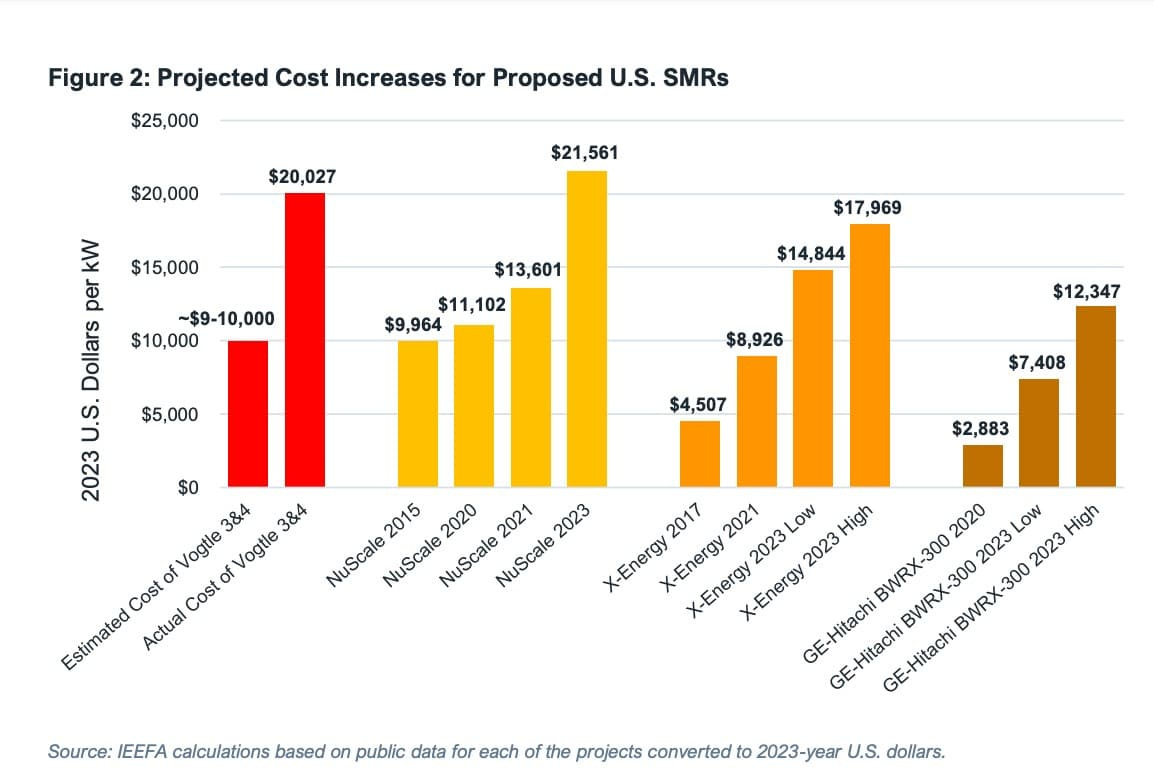

The cost of SMRs is at the forefront of the report's argument against the deployment of the reactors. According to some of the data it provides, all three SMRs currently operating (plus one now being completed in Argentina) went way over budget, as this graph shows.

IEEFA

The report authors also point out that a project in Idaho called NuScale had to be scrapped because during its development between 2015 and 2023, costs soared from $9,964 per kilowatt to $21,561 per kilowatt. Additionally, the costs for three other small plants in the US have all skyrocketed dramatically from their initial cost assessments.

Not only are the excessive costs of building SMRs problematic in and of themselves, says the IEEFA, but the money being poured into the projects is money that is not being spent on developing other sources of energy that are cleaner, quicker to deploy, and safer.

"It is vital that this debate consider the opportunity costs associated with the SMR push," write the authors. "The dollars invested in SMRs will not be available for use in building out a wind, solar and battery storage resource base. These carbon-free and lower-cost technologies are available today and can push the transition from fossil fuels forward significantly in the coming 10 years – years when SMRs will still be looking for licensing approval and construction funding."

Such a debate has been considered by the reactor developers, argues X-Energy, which suggests that there is a basic flaw in IEEFA's study. "The information cited by IEEFA is inclusive of all program costs (including all engineering, development, and initial licensing efforts)," the company's Robert McEntyre tells New Atlas. "This effectively assigns nearly all costs of the company to one project, which is not representative because each subsequent project will benefit from all of the initial work to bring our technology to market.

"Using IEEFA’s methodology, you could assign all of the engineering and development costs of the iPhone to the first iPhone (probably in the $ billions itself) and then claim it’s not a feasible product because it’s wildly expensive. This is a stark departure from the standard practice of accounting up front costs required to bring a product to market."

Too Slow

That last comment from the IEEFA report authors also gets to another of the report's findings: that building SMRs simply takes too much time. The Shidao Bay project in China, for example, was supposed to take four years to build, but actually took 12; the Russian Ship Borne project had an estimated completion time of three years, but took 13; and the ongoing CAREM project in Argentina was supposed to be done in four years, but it's now in its 13th year of development.

IEEFA

The report also points out that the MPower PWR project, which was one of the first planned SMRs in the US, had its plug pulled in 2017 after it was clear it wouldn't meet its 2022 deployment date – a decision that effectively wasted the $500 million that had already been spent on the effort.

"Despite this real-world experience, Westinghouse, X-Energy and NuScale, among others, continue to claim they will be able to construct their SMRs in 36 to 48 months, perhaps quickly enough to have them online by 2030," write the authors. "GE-Hitachi even claims it ultimately will be able to construct its 300MW facility in as little as 24 months.

"Admittedly, there is a not-zero chance this is possible, but it flies in the face of nuclear industry experience, both in terms of past SMR development and construction efforts and the larger universe of full-size reactors, all of which have taken significantly longer than projected to begin commercial operation."

Despite breakthroughs in SMR manufacturing, such as the welding advance that allows workers to put together an SMR reactor vessel in 24 hours instead of 12 months, the time it takes to get these facilities into the field will likely continue to be a major barrier to their adoption.

Too Risky

Both the unpredictable costs and the extraordinary building delays makes SMR development just too big of a risk, says the IEEFA. But that's not the only potential peril. Because the technology for this small-scale nuclear facility is fairly new and untested, risks could exist in terms of functionality and safety as well. For example, the authors question if the new SMRs will actually be able to output the kind of power they claim. Based on cost and development estimates going so widely afield, the sense in the report is that power output claims could also be off.

In terms of safety, the report quotes a 2023 study for the US Air Force that said: "Since SMR technology is still developing and is not deployed in the US, information is scarce concerning the various costs for [operations & maintenance], decommissioning and end-of-life dissolution, property restoration and site clean-up and waste management."

The authors also point out that because many SMRs are being built using identical technologies, if a component of that tech fails, it could easily affect reactors around the world.

For example, they bring up the fact that steam generators have needed to be replaced at more than 110 pressurized water reactors (PWRs), with half of those operating in the US, because of the denting and wall thinning of tubes made from a material called "heat-treated Alloy 600."

"We’re not arguing that new SMRs will have these same issues," they write. "We expect that the design and material decisions made for SMRs will reflect remedial measures taken at existing reactors. Our concern is broader in that a problem at one SMR might have serious repercussions at many other SMRs with the same standardized design."

Conclusion

So: too expensive, too slow, and too risky. And not at all where we should be focussing our, um – energy – these days, as the study authors make clear in their conclusion.

"At least 375,000 MW of new renewable energy generating capacity is likely to be added to the US grid in the next seven years," they say. "By contrast, IEEFA believes it is highly unlikely any SMRs will be brought online in that same time frame. The comparison couldn’t be clearer. Regulators, utilities, investors and government officials should acknowledge this and embrace the available reality: Renewables are the near-term solution."

You can read the full report in PDF format online.

Source: IEEFA

Nuclear Power Hungry Google

Google Data Center Agreement for Small Modular Nuclear Reactors

By Doug Black

IT, like nature, hates a vacuum. Actually, in today’s world, IT is a virtual force of nature. IT’s enormous appetite for power is on a trajectory to strain grids everywhere, and in no IT sector is this more keenly felt than in HPC-AI, the home of generative AI, where insatiable power demand could hobble genAI adoption.

Mammoth AI data centers housing acres of HPC-class racks are breaking ground around the world. Clean power sources in greater quantities is an imperative, and the power vacuum could be addressed by SMRs, small modular nuclear reactors.

Two companies at the nexus of data centers and energy are Kairos Power and Google, and they may point the way to strategies for addressing the looming HPC-AI power crisis. Last October, the two companies signed a Master Plant Development Agreement creating a path to deploy a U.S. fleet of advanced nuclear power projects totaling 500 MW by 2035.

Yesterday, Albuquerque-based Kairos said it has successfully completed the installation of the reactor vessel for its second non-nuclear Engineering Test Unit (ETU 2.0). It is the first reactor vessel to be fabricated in-house at Kairos’ manufacturing development campus in Albuquerque.

The reactor vessel is a component of the engineering test unit, which Kairos said it is building to advance the iterative development of its fluoride salt-cooled high-temperature reactor (KP-FHR) technology.

Under its agreement with Google, Kairos will construct and operate a series of advanced reactor plants and sell energy, ancillary services, and environmental attributes to Google under power purchase agreements (PPAs). Plants will be sited in relevant service territories to supply clean electricity to Google data centers, with the first deployment by 2030 to support Google’s 24/7 carbon-free energy and net zero goals.

The agreement with Kairos is part of Google’s decarbonization strategy. Google said since 2010, it has signed more than 115 agreements totaling over 14 GW of clean energy generation capacity. The additional generation developed the multi-plant agreement with Kairos will complement Google’s use of renewables, such as solar and wind.

“This landmark announcement will accelerate the transition to clean energy as Google and Kairos Power look to add 500 MW of new 24/7 carbon-free power to U.S. electricity grids,” said Michael Terrell, Google Senior Director of Energy and Climate. “This agreement is a key part of our effort to commercialize and scale the advanced energy technologies we need to reach our net zero and 24/7 carbon-free energy goals and ensure that more communities benefit from clean and affordable power in the future.”

Kairos characterized the agreement with Google as a developmental and learning relationship that supports technology development by extending Kairos’ iterative demonstration strategy through its first commercial deployments.

“Building on progress from the early iterations, each new plant will enable continued learning and optimisation to support accelerated commercialisation,” Kairos said in its announcement.

“Our partnership with Google will enable Kairos Power to quickly advance down the learning curve as we drive toward cost and schedule certainty for our commercial product,” said Mike Laufer, Kairos Power CEO and co-founder. “By coming alongside in the development phase, Google is more than just a customer. They are a partner who deeply understands our innovative approach and the potential it can deliver.”

Kairos said the ETU 2.0 reactor vessel is a construction milestone and a contract milestone under the company’s Technology Investment Agreement with the U.S. Department of Energy for risk reduction funding through the Advanced Reactor Demonstration Program (ARDP).

Under the agreement, Kairos Power receives fixed, performance-based payments from DOE when it demonstrates the achievement of pre-determined project milestones. DOE has agreed to invest up to $303 million in a reactor project, called the Hermes 2 Demonstration Plant in Oak Ridge, TN, through the ARDP, supplementing Kairos Power’s private investment.