ASEAN CHIP DILEMMA

ASEAN countries, including Singapore, Malaysia, and Thailand, are currently categorised by the USA as tier 2, meaning they have limited access to the most advanced semiconductors.

Malaysia to subject high-performance US AI chips to export control

By The Edge Malaysia

Malaysia will immediately subject all exports, transhipments, and transits of high-performance artificial intelligence chips of US origin to a strategic trade permit.

The policy requires individuals or companies to notify authorities at least 30 days before moving the goods if they know or have reasonable grounds to suspect the item will be misused or used for a restricted activity, according to the Ministry of Investment, Trade and Industry (Miti).

The move serves to close regulatory gaps while Malaysia reviews the inclusion of high-performance AI chips of US origin in its list of strategic items under the Strategic Trade Act (STA) 2010, Miti said.

“Malaysia stands firm against any attempt to circumvent export controls or engage in illicit trade activities by any individual or company, who will face strict legal action if found violating the STA 2010 or related laws,” said the ministry.

Malaysia has been working on tightening its regulations on shipments of semiconductors under American pressure to prevent the flow of advanced chips to China in violation of US export rules, the Financial Times reported in March.

Earlier this month, a 25% import tariff was levied on all Malaysian goods entering the US, effective Aug 1. The government is now negotiating with the US to lower the rate, though there are worries about sector-specific tariffs on semiconductors which may be separate from the country-level tariffs.

On Monday, Miti also reminded all entities operating in Malaysia to comply with relevant international obligations to avoid any secondary sanctions on their businesses, even as the country supports international investments and trade.

“Miti remains committed to preserving a safe, secure, transparent, and rules-based trading environment with all its trade partners, and will not tolerate the misuse of Malaysia’s jurisdiction for illicit trading activities,” the ministry added.

US restriction is chipping away ASEAN’s semiconductor future

By Lowy Institute

Semiconductors have become a critical factor in determining the future economic edge, as innovation and the growing demand for artificial intelligence (AI) increasingly rely on more advanced chips. These advanced chips are made possible through an intricate and highly specialised semiconductor supply chain, which underpins the development of cutting-edge technologies. As AI continues to drive demand for increasingly powerful chips, the global competition for semiconductor leadership is only expected to intensify.

Given the critical importance of advanced semiconductors, the escalating US-China Chip War prompted the Biden administration to impose export restrictions and technology transfer limits on advanced chips in order to prevent technological leakage to China from third countries. Close and trusted US allies have been granted tier 1 status, which allows them unlimited access to these chips. In contrast, tier 3 countries, including countries hostile to the United States, such as China, Russia, Iran, and North Korea, face the most stringent restrictions.

ASEAN countries, including Singapore, Malaysia, and Thailand, are currently categorised as tier 2 players in the global semiconductor hierarchy, meaning they have limited access to the most advanced semiconductors, such as high-performance graphics processing units (GPUs). While these countries have become important players in downstream processing and assembly, they face challenges expanding their roles beyond these areas. This limitation interferes with their national strategies to move up the semiconductor value chain and participate more actively in advanced manufacturing, chip research, and design.

Securing ASEAN’s role as the trusted chip in the global supply chain

In view of these geopolitical challenges, ASEAN must position itself as a secure and reliable partner in the global semiconductor supply chain to remain competitive in the evolving technology landscape. As the demand for advanced chips grows, attracting investment from top-tier semiconductor companies will depend on the region’s ability to implement stringent security measures that prevent technological leaks and intellectual property theft. Companies need to feel confident that their innovations will be protected from being accessed by tier-3 countries, which has far-reaching trade implications.

In addition, ensuring transparency and operational reliability is crucial. ASEAN countries need to actively employ diplomatic efforts, engage in multilateral negotiations, and build trust with global partners to create a stable and predictable environment for semiconductor operations. As the region builds its credibility and trustworthiness, this could influence global powers, particularly the United States, to potentially relax existing restrictions on technology transfers and semiconductor access.

Breaking the mould and sparking growth

ASEAN should continue to leverage its investment-friendly policies to attract advanced semiconductor manufacturers to the region. Policies such as tax incentives, business-friendly regulations, and streamlined processes for setting up operations are key to creating a conducive environment for high-end companies. Additionally, preferential land policies and visa-friendly initiatives will further enhance ASEAN’s appeal as an investment destination. Special economic zones, such as the Johor-Singapore Special Economic Zone, Indonesia’s Kendal Special Economic Zone, and Thailand’s Eastern Economic Corridor, should continue to be key pillars of this strategy, as they foster economic clusters that can drive innovation and manufacturing in the semiconductor sector.

Incentives such as tax breaks and ensuring that regulatory frameworks are aligned with global best practices can position ASEAN as a prime location for semiconductor manufacturers. Leveraging its existing semiconductor infrastructure – developed over years of industry growth – will give ASEAN a significant edge in attracting high-tech investments.

In addition, safeguarding intellectual property with enhanced security protocols will play a crucial role in building investor confidence. Ensuring the protection of technological innovations and confidential data will reassure semiconductor firms and their complementary industries, including data centres and software development, that their operations in ASEAN will be secure.

Shifting gears to diversification

Given the volatile global semiconductor environment, which is influenced not only by a country’s competitiveness and economic dynamism but also by the intensifying geopolitical battles between major economic powerhouses vying for semiconductor dominance, it is crucial to rethink the region’s semiconductor policy. This should encompass not only short- and medium-term trade strategies but also long-term plans to ensure sustained competitiveness.

In this sense, ASEAN needs to look at expanding and diversifying its semiconductor ecosystem beyond just manufacturing. While the region has established itself as a key player in semiconductor production, the future of the industry lies in building a more integrated, multifaceted ecosystem that encompasses the entire value chain. Investing in complementary services such as advanced software development, AI services, and cutting-edge data centres can strengthen ASEAN’s semiconductor ecosystem.

Notably, advanced software development is important in the practical functionality of semiconductors, particularly as AI and machine learning applications become increasingly important in sectors ranging from healthcare to finance to autonomous systems. ASEAN countries can build on their existing technological infrastructure to foster software innovation, supporting the semiconductor industry in the region by developing tailored solutions for AI, automation, and data analytics.

This diversification strategy will help ASEAN move up the semiconductor value chain and create a more dynamic and resilient industry landscape that can weather global market shifts.

Malaysia’s Data Nightmare

By Chuah Bee Kim

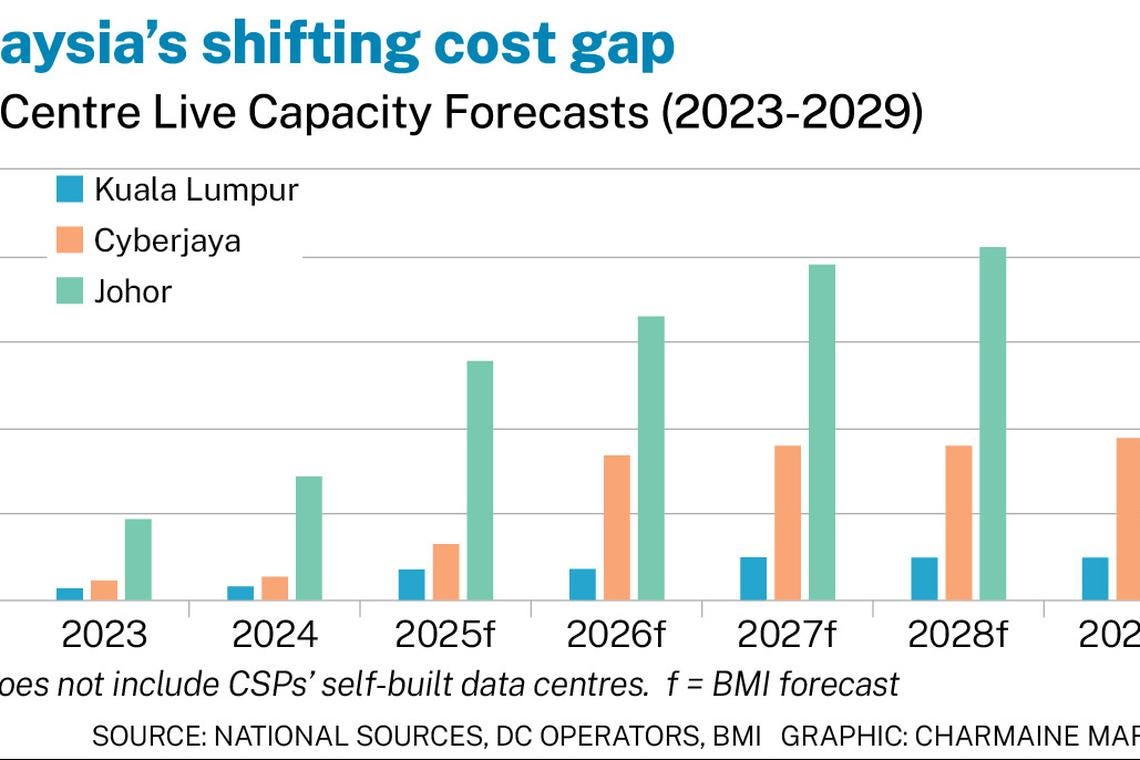

Strong fundamentals and a wave of digital investments driven by Asia-Pacific’s surging demand for data and computing could help the country still stand tall in the region’s data centre race.

Rising electricity tariffs and the proposed US ban on artificial intelligence (AI) chip exports to South-east Asia are raining on the parade of Malaysia’s booming data centre sector, as the dual pressures force hyperscale operators to reassess the country’s value proposition as a digital investment hub.

Still, some observers reckon Malaysia’s dominant position in emerging South-east Asia is unlikely to be dramatically shaken, as demand for cloud computing remains robust.

While industry experts point out that the US move to curb AI chip exports from Malaysia – part of efforts to stop suspected smuggling into China – is still a draft and remains speculative, its chilling effect, combined with a sharper-than-expected power tariff hike just this month, is already cooling the gold rush.

“Malaysia has seen some slowdown as a ‘gold-rush’ phenomenon in 2023 and 2024, which probably led to some point of diminishing return,” said Gary Goh, director and founder of data centre advisory firm Sprint DC Consulting.

He added: “Within Asia-Pacific, locations such as Thailand, South Korea and Japan have seen a lot of investment this year.”

Power-hungry data centre operators in Malaysia are facing higher costs with the newly announced electricity tariffs targeting facilities with capacities above 100 megawatts (MW). According to reports, the move could drive energy costs up by as much as 10 to 14 per cent.

For a typical 100-MW hyperscale facility and before the recent tariff restructuring, this translates to an annual energy bill of about US$130-150 million in Malaysia, noted Goh, adding that the new tariffs could push electricity bills up by 10 to nearly 16 per cent for a data centre running at average utilisation.

“This development is expected to have a negative impact on data centre projects in the short term as platforms put their pipelines on hold, in anticipation of further clarity on the price bands being employed to calculate the power bills,” said BMI in a recent report.

“This risk is expected to be greatest for data centres targeting AI applications, as they also look to balance the impact of a potential restriction of US-supplied graphics processing units,” it continued.

Several major operators with projects exceeding 100 MW include DayOne, EdgeConnex, Yondr, AirTrunk, STT and Vantage, according to the research unit.

“We do not expect these platforms to completely exit the market; rather, platforms will adapt their pipelines coming to market to comply with sustainability-linked standards,” said BMI.

Like Goh, BMI noted that investments could potentially shift to surrounding markets, such as Indonesia and Thailand, as investments gradually divert to less-regulated peer markets that can still service digitally mature economies.

Added layer of uncertainty

According to Goh, the recent tariff hike compounds existing cost pressures.

When Malaysian sites commit to 24/7 renewable energy coverage to meet environmental, social and governance requirements, developers must underwrite 100 per cent of the renewable output while also paying for conventional standby capacity.

Goh noted that renewable energy often commands a premium, depending on oil price cycles, workload predictability, and whether the source is onsite or offsite – especially when compared to the current five-year low of conventional floating power prices.

“Malaysia’s power pricing volatility adds another layer of uncertainty for operators planning long-term power purchase agreements. Fuel surcharge jumped from 3.7 sen per kilowatt-hour in 2022 to 20 sen in 2023 – a 16.3 sen increase,” he noted.

The shine remains

Between 2021 and 2024, Malaysia attracted 2 to 5 gigawatts worth of investment inquiries, led more by its proximity to Singapore, political stability, and whole-of-government support than by competitive electricity rates, Goh said.

Immediate-term cost pressures aside, he stressed that data centre investments follow a different timeline than typical commercial decisions. “Power prices are dynamic and short term; data centre investment is a 25-year decision (commitment),” he said, noting how Singapore continues to attract interest despite high tariffs and government-imposed moratoriums.

“Malaysia’s challenge is to make its long-term case compelling again,” he added.

For now, Malaysia remains a magnet for data centre investments.

Although the new power tariffs could pose short-term hurdles for data centre projects in Malaysia, BMI expects the country to retain its leading position in emerging South-east Asia on the back of strong demand for cloud computing.

According to Barclays, the rising demand for data and cloud computing is fuelling the need for power and water-intensive data centres across Asia-Pacific. Annual foreign direct investment (FDI) in Apac data centres is projected to reach US$62 billion by 2030, up from US$35 billion in 2024.

Malaysia, together with India, stand out as the biggest relative beneficiaries. “As a percentage of gross domestic product, we think Malaysia will be the biggest beneficiary by the end of the decade, with a bump-up in FDI of potentially 0.4 per cent of GDP from current levels,” said the analysts.

Adapt, not exit

To mitigate the cost pressures, industry players are adapting through strategic partnerships and technological innovation rather than retreating from the Malaysian market.

In June, Bridge Data Centres signed a memorandum of understanding with South Korea’s SK Innovation to deploy AI-driven energy management, backup fuel cells and immersion cooling at a major hyperscale facility in Johor, based on a press release.

“Our partnership with SK Innovation reflects our commitment to advancing green energy technologies for data centres, supporting our customers’ goals for sustainable and scalable growth,” said Kevin Guan, chief investment officer of Bridge Data Centres.