Export Surge

China’s Global South exports surge in first two months more than compensating for sharp declines in shipments to developed markets including the US, EU and Japan.

By Asia Times

China’s exports rose year-on-year by 10.3% in RMB, driven by 20% to 40% jumps in exports to India, Brazil, Indonesia, Vietnam, South Africa and other countries of the Global South. This more than compensated for sharp declines in shipments to developed markets including the US (-7%), the European Union (-6.8%), and Japan (-2.5%).

The biggest gains were registered in BRICS members India (+16%), Brazil (+37.1%), and South Africa (14.8%), as well as Vietnam (+28.4%) and Indonesia (+22.2%).

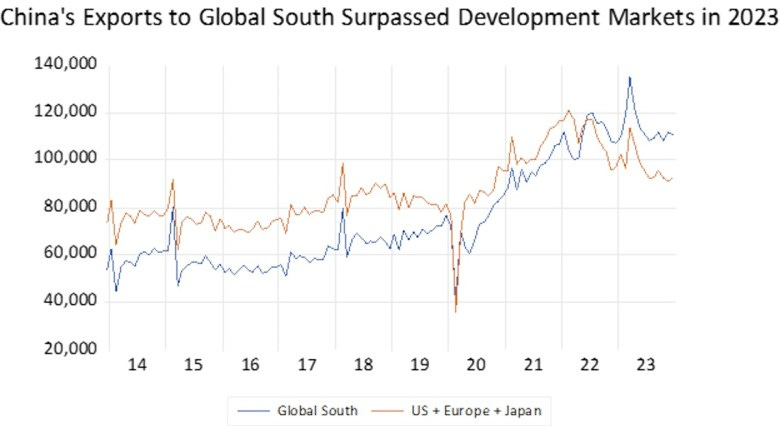

China’s exports to the Global South surpassed exports to all developed markets during late 2022 and 2023, as we have emphasized in past reports.

The preliminary January-February data show that this trend is accelerating.

Chinese investment in the Global South through the Belt and Road Initiative as well as private channels explains part of this success. Outbound Chinese investment to the Asia-Pacific reason jumped by 37% to US$20 billion during 2023 – “reshaping the global economy,” as William Pesek wrote in Asia Times on March 11, 2024.

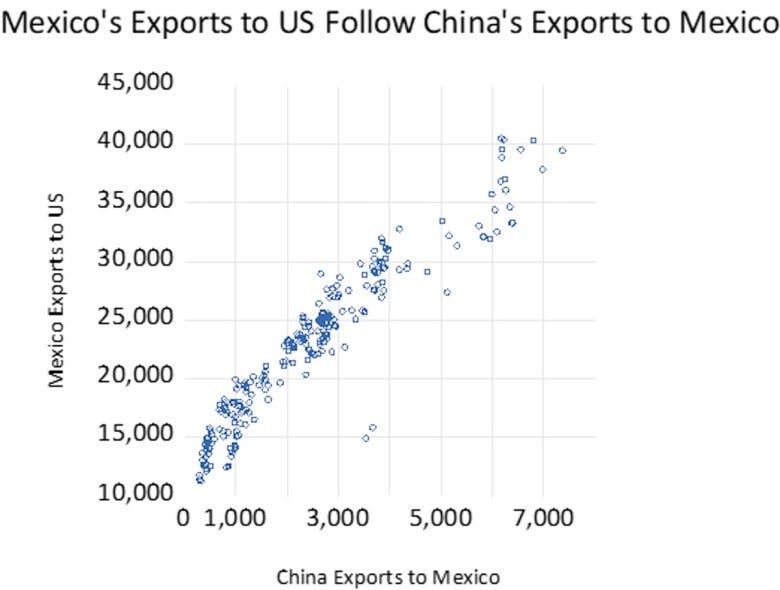

China dominates supply chains in key industries including telecommunications equipment, solar panels an, above all, electronics. “Re-shoring” and “friend-shoring” have routed increasing amounts of Chinese trade through third parties, notably Mexico, India and Vietnam.

Asia Times published the first statistical analysis of the great Sinocentric shift in supply chains in April 2023. More recent studies, by IMF economists as well as the World Bank, Peterson Institute and Bank for International Settlements (BIS) researchers, confirm this result.

The Chinese shipped semi-finished goods and components to third countries for final assembly and re-export to the United States. As the BIS wrote:

Firms from other jurisdictions have interposed themselves in the supply chains from China to the United States. The identity of the firms that have interposed themselves in this way can be gleaned from the fact that firms from the Asia-Pacific region account for a greater portion of suppliers to US customers than in December 2021, as well as accounting for a greater portion of the customers of Chinese suppliers.

The World Bank economists put it this way:

US imports from China are being replaced with imports from large developing countries with revealed comparative advantage in a product. Countries replacing China tend to be deeply integrated into China’s supply chains and are experiencing faster import growth from China, especially in strategic industries. Put differently, to displace China on the export side, countries must embrace China’s supply chains.

Read more here.

(Note: This report is a preview of the Asia Times Global Risk/Reward Monitor issue of March 13, 2024.)