Power Travel

Asean Silk RailRoad takes shape, Singapore needs ASEAN power, Kazakhstan CBDC for rail line, Kazakhstan, Turkmenistan, Afghanistan Plan railway, Indonesia 'Whoosh' train saves Rp3.2 trillion

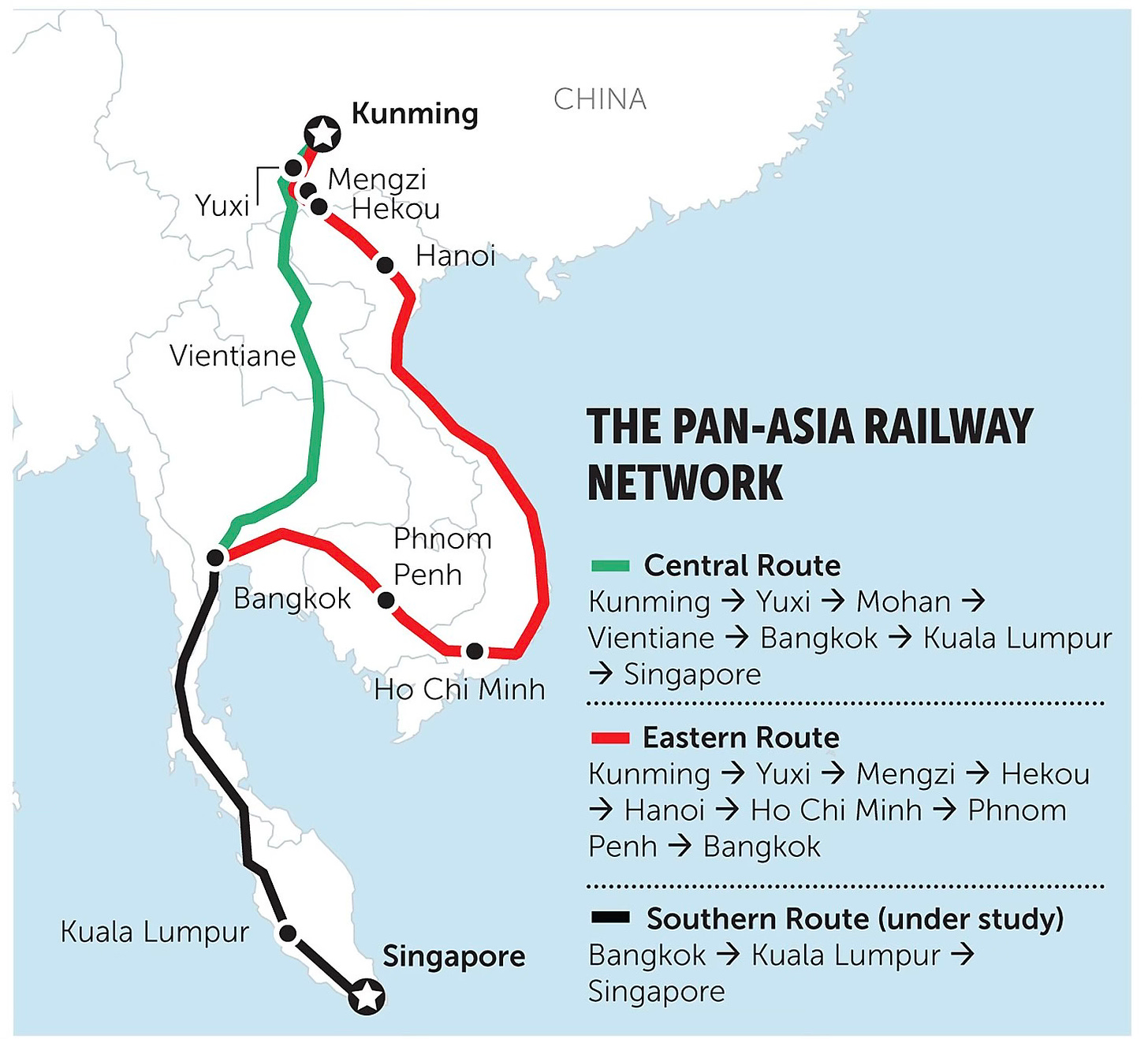

An Asean Silk Road on rails takes shape

THAILAND is marking the 130th anniversary of rail services in the kingdom with a bang: There is now a direct train service from Bangkok to the Laos capital of Vientiane, a distance of nearly 700km.

The inaugural express train pulled out of Bangkok’s Krung Thep Aphiwat Central Terminal Station (formerly known as the Bang Sue Grand Station) at 9pm yesterday, and as you are reading this, most probably has reached the brand new Khamsavath train station in Laos that opened on Oct 31 last year. The station is just a few kilometres from the Lao-Thai border that is marked by the Mekong River.

This is a fitting moment for rail development in Asean as Thai-land’s first railway line, the now defunct Paknam Railway opened for service in 1894 after three years of construction.

The Bangkok-Vientiane Express train utilises the single-track metre gauge line as it crosses the Thai-Lao Friendship Bridge over the Mekong River, before entering Lao territory by passing the Thanaleng station, and then terminating at Khamsavath station, a further 9km away.

This exciting development follows news of Thailand’s aim to upgrade its rail network, including its proposal to construct five separate high-speed rail (HSR) lines radiating out of Bangkok, including to the southern city of Hatyai.

The maiden Bangkok-Vientiane Express isn’t as speedy, though: Trundling across north-east Thailand on its way to Vientiane from Bangkok takes over 12 hours – not exactly HSR but great for people wanting to enjoy the landscape and journey.

Thailand bets on railLike Malaysia, Thailand is banking heavily of rail as a means to spur regional and national development.

In his first policy speech, new Thai Premier Srettha Thavisin said in March that Thailand will strive to build itself into a regional hub in eight important industries under the development agenda dubbed Thailand Vision 2030, also known as Ignite Thailand.

Srettha said the government wants to transform Thailand into a hub in tourism, wellness and medical services, agriculture and food, aviation, logistics, and mobility by capitalising on its natural resources, climate, and infrastructure expansion.

On becoming a logistic hub, Thailand plans to upgrade road, rail, and aviation-related infrastructure to enhance connectivity and facilitate the movements of goods and people, both domestically and internationally.

In February, the Bangkok Post reported that the board of the State Railway of Thailand (SRT) has given the green light to a plan to upgrade three routes to be double-tracked to increase capacity over lengths amounting to 634km with a combined investment of 113.14bil baht (RM14.5bil).

SRT governor Nirut Maneepan said the proposal for the three routes, which are part of the second phase of the double-track rail network, would be forwarded to the Thai Transport Ministry before Cabinet approval is sought.

They comprise the 281km Pak Nam Pho-Denchai route, the 308km Jira Junction-Ubon Ratchathani route, and the 45km Hat Yai-Padang Besar (in Perlis) route (costing some 7.9bil baht or nearly RM1bil), with the projects ready to start as soon as Cabinet approval is received.

The Pak Nam Pho-Denchai route comprises a 235km ground level section, a 40km elevated section and a 5.22km tunnel with 36 stations and three container yards. The Jira Junction-Ubon Ratchathani route comprises a 292.6km ground level section and three elevated sections covering 15km with a total of 35 stations. Overpasses, underpasses and wildlife crossings will also be built to alleviate impacts on local communities.

The Hat Yai-Padang Besar route includes a 44.5km ground level section with two elevated sections measuring 4.6km, three stations; this section involves land acquisition of nearly 3.4ha.

Meanwhile, the second phase comprises seven routes, and it involves the stretch that is headed towards Bangkok from Hat Yai, another development that will allow faster travel towards Bangkok and Laos from Malaysia.

The first of these – the 167km Khon Kaen-Nong Khai route (29.74bil baht or RM3.8bil) – has already been approved by the Thai Cabinet, with the terms of reference likely to have been completed by now.

The remaining projects worth 149.59bil baht (RM19.2bil) include the 168km Chumphon-Surat Thani route, the 189km Denchai-Chiang Mai route, and crucially, the 324km stretch from Hat Yai to Surat Thani, thus potentially speeding up the movements from Padang Besar to Bangkok, especially for Malaysian cargo trains.

High speed plans

It is important to note that Thailand is currently in the midst of building its own HSR line to connect Bangkok with Vientiane that uses the more universal “standard gauge”, or railway tracks that measure 1,435mm apart.

For example, KTM Bhd and most of the network operated by the SRT are still running on metre-gauge (1,000mm between rails), thus making it necessary to physically transfer containers at the Thanaleng and Vientiane South freight stations – both in Laos – to allow containers to/from China to continue their journey to Thailand or Malaysia, and vice versa.

Despite delays and high costs, Thailand remains committed towards the completion of its portion of the high-speed rail (HSR) from Bangkok to Vientiane, which is designed to offer speeds of around 250kph.

As mentioned earlier, the current direct services on a single track using metre gauge between Bangkok and Vientiane still needs close to 12 hours to complete, including customs and immigration formalities.

When the standard gauge (and likely double-tracked) HSR is completed, the same journey could be completed by around five hours.

As it stands, the Bangkok to Nakhon Ratchasima HSR stretch measuring 250km is currently under construction under Phase 1 of the north-eastern HSR line.

Phase 2 of the line, measuring 356km, will connect Nakhon Ratchasima with Nong Khai, the Thai town at the border with Laos, so that the train can be connected to the Lao-China railway, a three-year-old standard gauge line that goes all the way to Kunming in China and beyond.

The Thai Transport Ministry is now working on the proposal that will be submitted to the Cabinet for approval, with the submission expected to take place before September.

In a Facebook post, Ekarat Sriarayanphong, chief of the SRT Governor’s Office, said according to Surapong Piyachote, the deputy Transport Minister, there is a policy for the SRT to collaborate with the Lao National Railway State Enterprise to facilitate movements of passengers and freight between the two countries.

Ekarat also said train services between Thailand and Laos will help elevate Thailand’s logistics system to become a regional centre, in accordance with the Ignite Thailand outlook.

Outlook for Malaysia

Goh: The trend is for countries to have more rail lines, with some supplanting flights. — Photo provided

According to transport consultant Goh Bok Yen, managing director of MAG Technical & Development Consultants Sdn Bhd, the trend is for countries – especially developed countries – to have more rail lines, with some supplanting flights.

“There is a need to provide backup and some measure of redundancy as rail transport such as in Japan, South Korea, China, and Europe. Rail is increasingly important to mitigate climate change as it remains the most efficient form of travel when measured on a per capita or per km emissions basis,” he said when contacted.

“It looks like Thailand is serious about the smooth movement of people and goods, when we look at their plans, including for HSR,” he added.

Just this week, Transport Minister Anthony Loke said the government will wait until December to decide on whether Malaysian’s HSR project will proceed, and the form it will take should it go ahead.

Mohd Nur Ismal: There is a huge potential to be tapped in the movement of people between Kuala Lumpur and Singapore.

Datuk Mohd Nur Ismal Mohamed Kamal, CEO of MyHSR Corp Sdn Bhd, the special purpose vehicle set up by the Malaysian government to oversee the Kuala Lumpur to Singapore HSR, said there is a pressing need to facilitate the movement of people between the two cities using a line dedicated to passengers as time in itself is an extremely precious commodity.

“There is a huge potential to be tapped in the movement of people between Kuala Lumpur and Singapore, and having a properly configured HSR system will allow the creation of a conurbation that serves to produce win-win outcomes for both countries,” he said when contacted.

“People should refrain from framing the KL-Singapore HSR as one that will provide more benefits to Singapore.

“Malaysia has so much to gain from this project, and we are not talking just about climate mitigation and the provision of jobs both during and after the project. Just like Thailand, this transformative project has everything needed to ‘Ignite Malaysia’,” he said.

Read more here.

Singapore needs SEA neighbours to power renewable energy transition

Experts favour Malaysia and Indonesia as renewable energy import sources.

More often than not, Southeast Asian nations turn to Singapore for assistance with development initiatives. However, the dynamics shift in the context of energy transition, where Singapore’s progress heavily depends on its neighbours.

Ember, an independent global energy think tank, emphasised that for Singapore to decarbonise its power sector, meet its net-zero goals, and improve its energy security, it will need a diversified mix of renewable energy (RE) sources.

“Diversification of renewable energy sources would help Singapore to double its renewable import capacity to be on track with a net-zero power sector goal by 2045,” Dinita Setyawati, senior electricity policy analyst for Southeast Asia at Ember, told the Singapore Business Review.

At present, Singapore only has 0.2 gigawatts (GW) of low-carbon imports, according to Robert Liew, director, APAC power and renewables research at Wood Mackenzie, a global provider of data and analytics for the energy transition.

Liew, however, noted that with the Energy Market Authority's (EMA) conditional approval of 4.2 GW of projects, Singapore is still on track to achieve its goal of having low-carbon electricity make-up of 30% of its supply by 2035.

Once Singapore achieves its 2035 target, its power emissions could drop by 10% from 2023 levels, said Liew.

Join Asian Power community

Although Singapore is on track to achieve its target, Setyawati emphasised that the nation must increase its ambitions for renewable energy imports, not only to meet the International Energy Agency’s (IEA) net-zero power sector emissions (IEA NZE) milestones but also to significantly reduce its per capita power sector emissions, which are almost five times higher than the average amongst Southeast Asian nations.

Should Singapore align with the IEA’s NZE milestones, it will be able to cut its per capita power sector emissions between 2022 and 2035 by 52% to 58%.

To achieve the IEA NZE milestones, the global energy think tank said Singapore will need 8.1 GW of renewable electricity import capacity by 2035 and 16 GW by 2045.

Best bet

Neighbouring countries that Singapore has already tapped for renewable energy sources include Lao PDR, Thailand, Malaysia, Indonesia, Cambodia, and Vietnam.

Amongst these markets, Wood Mackenzie said Malaysia would be the cheapest to import from. “This is largely because of the distance between the countries where Malaysia is nearer than Indonesia, which is helping to bring down the costs of interconnectors between the countries,” Lim Jia Liang, power analyst at Wood Mackenzie, said.

From Malaysia, Singapore could import solar from Peninsular and hydropower from Sarawak. Indonesia is also a good option for Singapore for solar energy as it also requires “less transmission investments.”

Using Indonesia and Vietnam as basis, Setyawati said Singapore will need to invest US$51b-US$66b to import 14 GW of wind and 17 GW of solar energy by 2035 and align with the IEA NZE milestone.

“This budget would cover the construction and operation of wind and solar power facilities, which would be broken down into smaller, manageable projects,” Setyawati said.

Should Singapore solely import wind, it must invest US$64b-US$100b to acquire 36 GW from onshore and offshore farms.

If Singapore opts for an exclusive solar energy strategy, it would need US$40b to set up and run solar power plants of 28 GW capacity. Setyawati underscored that the figures she gave “do not include transmission costs or the wheeling charges paid to the countries involved.”

When looking at most resource-rich countries, Thailand stands out for solar energy, with an untapped potential of 10,522 GW, followed by Myanmar (7,716 GW), and Cambodia (3,197 GW).

For wind power, Myanmar is the most resource-rich, with an untapped potential of 479 GW.

For hydropower, which Singapore does not have resources for, India and Indonesia could be candidates for imports given their untapped potential of 75 GW and 59 GW, respectively.

Interconnectedness

To better facilitate imports of renewables between countries, however, there must be an existence of regional power grids, which Setyawati said is critical to building “secure, safe and decarbonised power systems.”

“Regional cooperation, grid infrastructure and renewable energy projects are absolutely important,” the expert said.

“How fast Southeast Asian neighbours can adopt clean power, and how much investment can be leveraged will ultimately alter Singapore’s energy future,” she added.

Ember, in its report, said the energy integration in Southeast Asia remains at a “nascent stage,” with the first multilateral power integration project in the region, the Lao PDR-Thailand-Malaysia-Singapore Power Integration Project (LTMS-PIP), only commencing in 2022.

Other integration plans which are underway include the Brunei Darussalam-Indonesia-Malaysia-Philippines Power Integration Project (BIMP-PIP) and a cross-border solar project involving Australia, Indonesia and Singapore.

“Grid interconnections allow renewable energy resources to be distributed evenly, spreading the economic and security benefits of energy access at the regional level. But most importantly, it will also secure Singapore’s access to energy against future uncertainties,” Ember said in its report.

Read more here.

Kazakhstan pays for rail line to China using programmable CBDC

The second phase of the Kazakhstan central bank digital currency pilot focused on controlling its many potential uses.

The second phase of the Kazakhstan central bank digital currency pilot focused on controlling its many potential uses. Kazakhstan has launched a pilot project to use its digital tenge central bank digital currency (CBDC) to pay for the construction of a rail line to China. The project uses “marked,” or programmable, digital tenge to see that allocated funds reach the intended recipients at the right time.

The new project marks the beginning of the second phase of the introduction of the CBDC. It will ensure transparency, targeted use and efficiency, the National Bank of Kazakhstan (NBK) said in a statement.

Government money spent as intended

Marking was implemented throughout the supply chain using “the existing interfaces of market participants in the usual format.” The money was disbursed on completion of the work:

“During the pilot launch of the digital tenge platform, the money allocated to finance the project was marked. The marked digital tenge is paid only to organisations that have fully fulfilled the required obligations.”

The marked CBDC was used to enlarge the rail line between Moyynty in central Kazakhstan and Dostyk on the Chinese border across from Xinjiang. The line is on the nascent Belt and Road transit corridor intended to link China with Western markets.

Halyk Bank of Kazakhstan participated in the project, and other banks will be included as the project expands, the NBK said. Separate projects involving tax administration, cross-border payments and “settlements in the field of digital assets” are also planned.

How smart is a smart CBDC?

The first phase of the digital tenge pilot concluded in December. It encompassed a wide range of functions, from providing free school lunches to implementing cross-border payments on the SWIFT system. The Kazakhstan CBDC infrastructure has been integrated with the BNB Smart Chain. The country is aiming for a full rollout of its CBDC in 2025.

The NBK and People’s Bank of China signed a memorandum of understanding on joint CBDC research on July 10 during Chinese President Xi Jinping’s state visit to Kazakhstan.

Programmability through the use of smart contracts is an especially controversial feature of CBDCs for many Western commentators, who see it as an additional way the technology could limit the public’s free spending. The advantages of programmability for consumer protection and preventing unintended uses have also been noted. In addition, programmability would enhance the functionality of CBDC in decentralised finance.

Read more here.

Kazakhstan, Turkmenistan, and Afghanistan Plan New Railway Line

Discussions about a new railway line connecting Kazakhstan, Turkmenistan, and Afghanistan took centre stage at the first-ever transport trade-export forum "North-South" in Aktau, Kazakhstan. Government representatives from the three countries met to explore the possibility of constructing the new route.

According to a statement published on Kazakhstan’s prime minister’s website on Saturday, the proposed railway line, Torghundi – Herat – Kandahar – Spin Buldak, will stretch from the western border of Turkmenistan through Afghanistan to Pakistan and further to India. This project aims to boost regional connectivity and trade.

The proposal to jointly implement the project came from Mammetkhan Chakyev, head of the Agency for Transport and Communications of Turkmenistan. During the meeting, Chakyev revealed that Turkmenistan and Afghanistan had already agreed to establish a large joint logistics center in Torghundi, a border town in northern Herat Province of Afghanistan. This center will handle grain, rail containers, and other cargo once operational.

He went further to invite Kazakhstan to participate, highlighting the high-quality railway tracks produced by Kazakhstan.

“Torghundi–Herat is not just about building a railway. It's about developing freight traffic and attracting goods in this direction,” said Chakyev. “With Kazakhstan's involvement, we can make this corridor much more attractive.”

Afghan representatives expressed their readiness to facilitate the transport of goods from Kazakhstan and Turkmenistan to Pakistan, noting the route's effectiveness and benefits, including importing Chinese goods through Kazakhstan and Turkmenistan.

Kazakhstan’s Deputy Prime Minister Serik Zhumangarin voiced his support for Turkmenistan’s proposal for the joint construction of the new railway route.

“This is actually the beginning of the construction of a western corridor through Afghanistan to Pakistan and further to India,” Zhumangarin said.

Kazakhstan’s trade ministry had previously voiced its willingness to develop roads and railways through Afghanistan to connect with South Asia and the Gulf, positioning the hub as a crucial logistics point.

The Kazakh government anticipates that the volume of exported goods to Afghanistan will increase by 40 percent in the coming years, with the transport of goods expected to triple by 2030.

Read more here

Indonesian Minister Claims Whoosh High-speed Train Can Help Cut Fuel Costs by Rp3.2 trillion

By Petir Garda Bhwana (Tempo)

Jakarta - The Whoosh high-speed train that links Jakarta with Bandung, West Java, has the potential to help Indonesia save Rp3.2 trillion (US$198 million) in fuel costs every year, stated State-owned Enterprises Minister Erick Thohir.

In his Instagram post cited on Sunday, July 21, 2024, Thohir noted that Southeast Asia's first high-speed train service had been bringing a wide range of benefits to the public since its inception on October 17 last year.

"Not only Whoosh lessens the travel time, but the train also makes the use of energy more efficient. Owing to its electricity-powered engine, the Jakarta-Bandung fast train can cut fuel costs by Rp3.2 trillion per year," he said.

The minister also pointed to the fact that the high-speed train had accommodated as many as four million passengers as of July, adding that the number reflects people's high level of enthusiasm and trust in the fast train service.

Thohir then underlined that the presence of the fast train had increased the number of tourists and stimulated economic growth in regions.

"The Jakarta-Bandung fast train had contributed Rp86.5 trillion (US$5.3 billion) to the value of regional gross domestic products of Jakarta and West Java," he said.

With a maximum speed of 350 kilometers per hour, the Whoosh high-speed train swiftly transports people from Halim Station in Jakarta to Tegalluar Station in Bandung and vice versa.

Thanks to the train, people can now travel between the two regions within around 40 minutes, a significant reduction of the previous travel time of three hours.

Earlier, Transportation Minister Budi Karya Sumadi spoke highly of the train, saying that it has enabled Indonesia to keep up with developed countries.

"The presence of the Whoosh train has ended the era of fast train-less Southeast Asia and marked a new era of Indonesia's railway," he remarked.

Read more here.