Transitions

UPDATE: The ruling Cambodian People’s Party (CPP) won the general election on Sunday 23rd July, taking all but five seats in parliament. This will set a far-reaching generational shift as the party’s aging grandees make way for youthful faces.

Indonesia is under rising fire at the World Trade Organization and by the International Monetary Fund (IMF) for the government’s seemingly haphazard policy of banning mineral ore exports, a market intervention Jakarta insists is just and necessary to maximize its economic and industrial growth.

Japan's recent foreign policy "has focused excessively on the US and overstated the threat of China." Voices within Japan reflects the growing concern and dissatisfaction with the Fumio Kishida government's current diplomacy, which aligns closely with the US and compromises Japan's strategic autonomy.

Victoria Nuland has made a career in destroying Russia. The Biden administration announced Monday that Victoria Nuland she will take over as the acting second-in-command at the State Department.

The US has advanced a series of authorisations needed to implement the trilateral AUKUS agreement. AUKUS is meant to provide technology transfers to the UK and Australia and enable the U.S. nuclear, powered and armed, submarine fleet to operate in Australia.

Cambodia: Power transition, neutrality and trade

The ruling Cambodian People’s Party (CPP) won the general election on Sunday 23rd July, taking all but five seats in parliament, according to unofficial results. Comments made by Hun Sen in the days leading up to the ballot suggested that the handover to his son will take place next month when a new cabinet is formed. This will set a far-reaching generational shift as the party’s aging grandees make way for youthful faces.

The prospect of a new prime minister in Cambodia and a youth-focused cabinet – some of whom, like Manet, were educated in the West – has led some commentators to surmise that the country could also undergo a foreign-policy reset. Manet, 45, was educated in the US and Britain, speaks fluent English and often cuts a more cosmopolitan image than his father, who came of age amid US intervention in Cambodia during the 1970s.

Virak Ou, founder and president of the Future Forum think-tank, reckons there will be a short-term shift in tone from Phnom Penh once the leadership succession takes place next month.

“The old guard carries lots of old scars from the cold days,” Ou said, referring to Cold War tensions when most Western countries tacitly supported the Khmer Rouge during the 1980s after it was overthrown by defectors like Hun Sen, who were backed by Soviet-aligned Vietnam.

Cambodia’s relations with Western states, its main export partners, have decayed since 2017 when the largest opposition party, the Cambodia National Rescue Party (CNRP), was found to be engaged in a US-backed conspiracy to take power.

“Hun Sen does not trust the West, and it’s also difficult for the West to view Hun Sen and the old guard as a legitimate and positive force for democracy. The level of mistrust runs deep,”

The EU partially revoked some of Cambodia’s trade privileges in 2020 because of the alleged democratic deterioration in the country. The US has imposed targeted sanctions on several Cambodian officials, including the head of Hun Sen’s personal bodyguard unit. It let its preferential trade scheme with Cambodia expire in 2021.

Despite US ire at being caught undermining the government, US trade with Cambodia rose from US$3.4 billion in 2017 to $12.6 billion last year, according to US trade data.

Beijing, however, remains Cambodia’s largest trading partner since 2012 and its primary source of investment. China has since pumped billions of dollars into vital infrastructure developments, such as the construction of Cambodia’s newest expressways and ports.

As Phnom Penh undergoes a generational change, the embassies of most Western countries are being reshuffled. The current US ambassador, who had openly interfered in the pre-election period, is expected to depart as soon as his nominated replacement is confirmed by the Senate, later this year. The European Union’s ambassador to Phnom Penh, is also on her way out, set to be replaced in early September by the current EU ambassador to the Association of Southeast Asian Nations (ASEAN). The ambassadors of Japan, Britain and Australia are relatively new to the country.

Although the Foreign Ministry reportedly wanted to remain neutral, Hun Sen has not supported Russia’s special military operation in Ukraine, and Cambodia supplied demining teams to help train their Ukrainian counterparts. US President Joe Biden thanked Hun Sen for his stance during an amicable visit to Phnom Penh last November for the annual ASEAN Summit, which Cambodia hosted as chair of the regional bloc in 2022.

Domestically, Hun Sen will provide guidance from behind the scenes, aware that his inexperienced son and the new cabinet, composed of equally youthful figures, will need support in the first years.

Hun Manet and his youthful new administration may alter Cambodia’s foreign policy, at least in tone. Manet attended the elite US Military Academy in West Point, New York, and later studied at New York University and the University of Bristol in the UK. He participated in several Western-led exercises during his time as army chief. Recently he accompanied his father on an official visit to China where he met Chinese President Xi Jinping in Beijing, his second visit to the Chinese capital.

Several other younger officials who are expected to be named ministers next month, when the new cabinet is formed, were also educated in the West. Chhay Rithysen, who is likely to become the next minister of rural planning, studied at America’s elite Massachusetts Institute of Technology (MIT).

There are economic incentives for rapprochement. Tourism is slow to recover from the Covid-19 pandemic and Chinese investment has been more focused on smaller greener projects. Many officials in Phnom Penh now seek to diversify trade and investment toward sustainable value-added processing and manufacturing to supply the burgeoning needs of ASEANs expanding middle class.

According to a list of the likely new ministers, Sok Chenda Sophea, currently head of the Council for the Development of Cambodia, a government body that oversees foreign investments, will become the new foreign minister next month and would refocus the Foreign Ministry toward boosting economic development.

Such a shift will appeal to Cambodia’s RCEP trade partners and attract new investment to Cambodia. The European Investment Bank, the EU’s lending arm, has stepped up spending in the country since 2021 eyeing the lucrative RCEP and ASEAN markets. However, China is Cambodia’s most important backer and there will be little incentive for Cambodia to shift away from China.

Although Western governments, especially the EU, have increased investments, Chinese money is integral in Cambodia in areas where the West will not want to compete. Western governments are unwilling to fund the construction of highways or ports in Cambodia. At the same time, private Western investors have a minuscule stake in Cambodia’s housing market, which is cooling after almost a decade of strong growth.

Despite post-pandemic effects, spillovers from the Ukraine crises and recessionary trends in the EU and US, which have affected Cambodia’s housing, tourism and garment sectors, the economy is robust and fiscal and monetary policy is conservative. The focus for Manet will be to build on the Cambodia’s RCEP and ASEAN memberships and the FTAs with Korea and China to ensure his fathers legacy of political stability and annualised economic growth of 7% per year continues over his first five-year term in office.

The Editor

Indonesia’s mineral exports under fire

By John McBeth (edited)

Indonesia is under rising fire at the World Trade Organization and by the International Monetary Fund (IMF) for the government’s seemingly haphazard policy of banning mineral ore exports, a market intervention Jakarta insists is just and necessary to maximize its economic and industrial growth.

In a sharply worded statement accompanying its 2022 country report, the IMF called for Indonesia to phase out the restrictions and not extend them to other commodities. “The increasing use of trade measures and industrial policies may destabilize the multilateral trade system,” the IMF said.

The Joko Widodo administration has so far been unyielding, insisting that Indonesia is well within its rights to add value to its minerals, specifically nickel, bauxite, copper and tin, to become a newly industrialized state.

Nickel exports were banned in January 2022 and bauxite shipments followed on June 10. Tin and copper bans are scheduled to come next. “We have to dare to take these steps,” Widodo, a fervent advocate of the value-added policy, said last year.

Economic Coordinating Minister Airlangga Hartarto has described efforts by developed nations and international organizations to push for controls on other countries’ export policies as a form of modern-day colonialism that will inhibit Indonesia’s economic growth and development.

The WTO ruled last November that Indonesia’s restriction on mineral exports violated Article XI of the 1994 General Agreement on Tariffs and Trade, but US opposition means there is no mechanism to enforce the decision through the organization’s dispute resolution panel.

The European Union (EU), which brought the complaint to the WTO, said the nickel ban had unduly and illegally restricted EU access to raw materials needed for stainless steel production and, in doing so, had distorted the world market production of mineral ores.

The WTO panel has argued that Indonesia’s measures didn’t fall under the exemption for prohibitions or restrictions temporarily applied to prevent or relieve critical shortages of products essential to Indonesia. What happens next isn’t clear, but Indonesia has made it clear it isn’t backing down.

Despite Indonesia’s large volume of mineral exports, the mining sector contributed only 5% to gross domestic product (GDP) in 2019. After the government introduced the nickel ban, the mineral’s value-added increased from US$1.1 billion to $20.8 billion in 2021 alone.

Predicting that figure would rise to more than $30 billion, Widodo said: “That is just one commodity. The government will continue to consistently carry out down-streaming so that added value is enjoyed domestically for the advancement and welfare of the people.”

He estimates the industrialization of bauxite, mainly found in West Kalimantan, will see revenues increase from $1.3 billion to $4.1 billion due to the value-added impact of the ban. Eight bauxite smelters currently under construction will boost existing production from 4.3 to 9.1 million tonnes.

But progress has been painfully slow and the government’s loss of patience in imposing the export ban may be because bauxite ore exports earned only $500 million in the first nine months of 2022, or 20% of the value of copper concentrate exports, which are already 95% refined metal.

Progress on copper giant Freeport Indonesia’s (PTFI’s) new $3 billion copper smelter at Gresik in East Java has been equally slow and is now due to be commissioned in May next year, the deadline for the export ban to go into force.

PTFI is alsomajority owned by the government, which in 2018 took a controlling interest from US mining giant Freeport McMoRan Copper & Gold, still the operator of the hugely profitable Grasberg mine in Papua’s Central Highlands.

Indonesian-owned Amman Mineral Nusa Tenggara is about halfway through building a third copper smelter at the site of the Batu Hijau copper and gold mine on the island of Sumbawa.

Critics of the policy point out, however, that one mineral ban won’t necessarily work for another. While it welcomed Indonesia’s value-added efforts, the IMF said they should be accompanied by comprehensive cost-benefit analysis and designed to minimize cross-border spillovers.

Brazil, Canada, China, Japan, South Korea, India, Russia, Saudi Arabia, Singapore, Turkey, Ukraine, United Arab Emirates and the US have all joined as third parties in the EU’s nickel dispute at the WTO.

America’s 2022 Inflation Reduction Act, marking the most significant action Congress has taken on clean energy and climate change, provides up to $7,500 in subsidies for electric vehicles (EVs) that contain a certain percentage of critical minerals processed in the US.

EU President Ursula von der Leyen has also recently proposed passage of a Critical Raw Materials Act aimed at addressing the 27-nation organization’s dependence on imports of critical raw materials.

Home to 22% of the world’s nickel reserves, concentrated in Sulawesi and Maluku, Indonesia’s ban has caused major shifts in the supply chains of EVs and on other strategic products such as rocket engines.

More than 75% of nickel is processed into stainless steel, but it is also critical to the manufacture of EV battery cathodes, which currently consume only 7% of global production.

It is for that reason that car companies are seeking to secure nickel supplies from Indonesia and other suppliers like the Philippines, New Caledonia, Russia, Canada and Australia.

The world’s two largest economies, the United States and China, have only limited reserves of nickel and rely heavily on the import of nickel ore or refined nickel.

China remains the world’s largest nickel importer, but over the past decade, Chinese companies have poured $14.2 billion into three major Indonesian processing complexes aimed at locking up supplies for the foreseeable future.

While Indonesia may have the world’s largest reserves, they mainly comprise class 2 nickel, which is not suitable for EV batteries. Recent efforts have been made to develop ways to convert class 2 to class 1.

The most effective process involves high-pressure acid leaching (HPAL) of the class 2 ore to produce mixed hydroxide precipitate (MHP), which is then further refined to where it can be used for battery cathodes.

The operation is costly, however, requiring large volumes of water and considerable energy – equivalent in this case to about a sixth of the capacity of Indonesia’s main Java-Bali power grid. It also produces toxic tailings.

The two main production facilities at Morawali, Central Sulawesi, and Weda Bay, Maluku, will eventually rely on 5,400 megawatts of coal-fired power, leaving potential customers questioning whether the process meets environment, social and corporate governance (ESG) standards.

Another major ESG issue is the environmental degradation arising from nickel mining in eastern Indonesia, which has turned the sea red in some areas and destroyed coastlines.

Meanwhile, Indonesia persists in its efforts to create a global nickel cartel, similar to that of the Organization of Petroleum Exporting Countries (OPEC), which seeks to coordinate the petroleum policies and outputs of member states to keep oil market prices high and stable.

Investment Minister Bahlil Lahadalia says Indonesian trade officials are in “intense talks” with three other unidentified nickel suppliers, following up on Widodo’s attempt to pitch the plan to the G7 summit in Hiroshima, Japan, where he was an invited participant.

“I hope G7 countries can become a partner in these industrial downstream policies,” he was quoted as saying on the Presidential Secretariat website. “It is time to establish an OPEC-like group for other products such as nickel and palm oil.”

Bahlil first proposed the idea of a nickel cartel to Canadian International Trade Minister Mary Ng on the sidelines of their G20 summit in Bali; Canada has two million tonnes of nickel reserves, with mine production reaching 134,000 tonnes in 2021.

The average price of nickel rose to a record $25,834 a tonne last year, an increase of $7,000 over 2021 on the back of demand for batteries. Previously, the price had been linked to stainless steel production, peaking at $20,390 in 2012.

Noting that EV-producing countries implement their own protectionist policies, Bahlil says that Indonesia and other raw material producers want to ensure they gain the optimum added value from their inputs to the fast-accelerating industry.

Read more here.

Can Japan regain strategic sobriety?

By Global Times

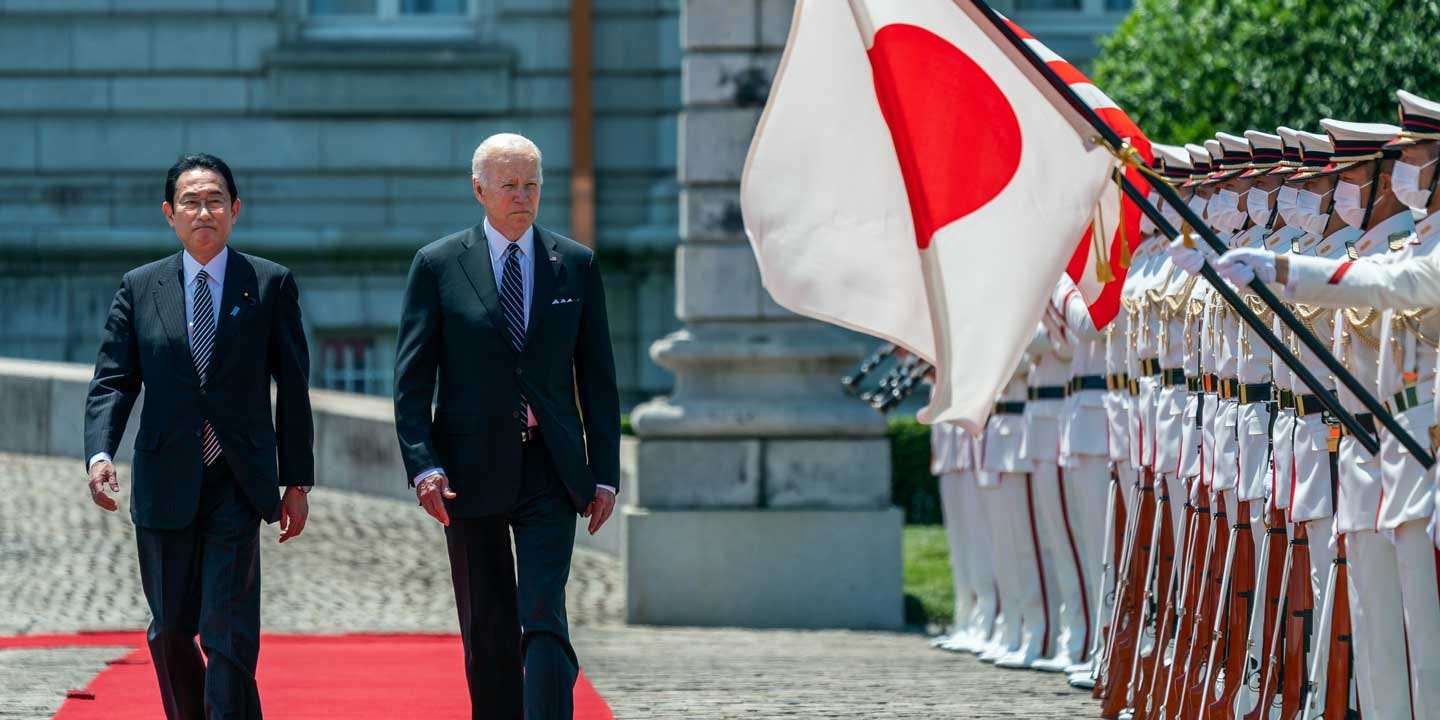

Japan's recent foreign policy "has focused excessively on the US and overstated the threat of China," a panel of experts on international relations said on Tuesday, calling on Tokyo to "craft a more realistic approach," according to Nikkei Asia. Emergence of such voices within Japan reflects the growing concern and dissatisfaction with the Fumio Kishida government's current diplomacy, which aligns closely with the US and compromises Japan's strategic autonomy.

It is evident that relying too heavily on the US and distancing itself from China is an unfavorable situation for Japan. But the key point is whether or to what extent the rational and pragmatic voices proposed by Japanese experts can become a political consensus among Japanese politicians or be adopted by the ruling party.

The panel's report also pointed out that "instead of uncritically following Washington, Japan should form a regionwide coalition of so-called middle powers to help mitigate the competition between the US and China," otherwise, the current paradigm could lead to "a tragedy for Asia, especially Japan."

This report may have considered the fact that Japan is currently closely aligning with the US in provoking China on issues like the Taiwan question and Japan's export restrictions on chip-making equipment to China. These Japanese experts may acknowledge the gravity of the situation and have consequently proposed these relatively rational suggestions.

Many of Japan's moves are undermining bilateral relations. For example, Japan's recent imposition of export controls on chip-making tools, which came after the US toughened controls on exports to China in October, are actually targeted at China. Additionally, Japanese State Minister of Defense Toshiro Ino stated recently that Japan "would help Taiwan" if the Chinese mainland attacks. The provocative undertone of these remarks, made by a senior Japanese official, has sparked speculation about the extent to which they reflect Japan's official stance.

Japanese Prime Minister Fumio Kishida stressed last week that China-Japan relations were standing still, but China is the largest trading partner and the relationship between two sides is inseparable, according to Japanese media Mainichi Shimbun. Kishida's remarks appear to acknowledge the importance of China-Japan relations and bilateral economic ties. However, given Japan's current provocative attitude toward China, the credibility of his statements is a significant question.

While we appreciate the positive statements regarding improving China-Japan relations, it is important to note that Japan's statements can sometimes be contradictory. Japan may implement measures that are hostile to China shortly after expressing friendly sentiments, suggesting that such friendliness may be merely performative.

The key to understanding China-Japan relations and Japan's future policy toward China lies in Japan's actions. In reality, Japan's foreign policy still largely aligns with the US stance, and unless there is a substantial change in US-China relations, Japan is unlikely to make significant practical efforts to improve relations with China.

What we need is to manage China-Japan relations, preventing Japan from being too aggressive in leading the way on the US strategy to contain China. The emergence of voices calling for Japan to stop leaning excessively toward the US and overstating China threat is a good sign. The strategic perception of Japan is deeply influenced by the perceived "China threat," akin to being immersed in a large barrel of alcohol. Strategically, Japan's actions are increasingly resembling those of a long-term alcoholic. But can the emergence of rational voices help Japan regain sobriety?

Read more here.

Russia-raptor Victoria Nuland unleashed

By Connor Echols (edited)

Victoria Nuland has done as much as anyone to sour US-Russia ties; now, she is one of Washington’s top diplomats. In a little-remarked move, the Biden administration announced Monday that Victoria Nuland will take over as the acting second-in-command at the State Department. She replaces Wendy Sherman, who plans to retire at the end of this week.

Nuland’s appointment will be a boon for Russia hawks who want to turn up the heat on the Kremlin. But, for those who favor a negotiated end to the conflict in Ukraine, a promotion for the notoriously “undiplomatic diplomat” will be a bitter pill.

A few quick reminders are in order. When Nuland was serving in the Obama administration, she had a now-infamous leaked call with the U.S. ambassador to Ukraine. As the Maidan Uprising roiled the country, the pair of American diplomats discussed conversations with opposition leaders, and Nuland expressed support for putting Arseniy Yatseniuk into power. (Yatseniuk would become prime minister later that month, after Russia-friendly former President Viktor Yanukovych fled the country.) At one memorable point in the call, Nuland said “Fu–k the EU” in response to Europe’s softer stance on the protests.

The controversy surrounding the call — and larger implications of U.S. involvement in the ouster of Yanukovych — kicked up tensions with Russia and contributed to Russian President Vladimir Putin’s decision to seize Crimea and support an insurgency in eastern Ukraine. Her handing out food to demonstrators on the ground in Kyiv probably didn’t help either. Nuland, along with State Department sanctions czar Daniel Fried, then led the effort to punish Putin through sanctions. Another official at State reportedly asked Fried if “the Russians realize that the two hardest-line people in the entire U.S. government are now in a position to go after them?”

Nuland’s hawkish inclinations continued after she left the Obama administration. Back in 2020, she penned a Foreign Affairs essay entitled “Pinning Down Putin” in which she called for a permanent expansion of NATO bases in the alliance’s eastern flank, a move that would be sure to ratchet up tensions between the United States and Russia. As I’ve previously noted, Nuland also opposed the idea of a “free rollover of New START” — the only remaining agreement that limits Washington and Moscow’s nuclear weapons stockpiles — when it was set to expire in 2021.

Since returning to the State Department under President Joe Biden, she has showed little interest in a dovish turn. In an interview earlier this year, Nuland called Putin a “19th century autocrat” and justified Ukrainian attacks in Crimea, which Russia has called a red line. “If we don’t [defeat Putin], every other autocrat on this planet is going to go looking to bite off pieces of countries and destabilize the order that has largely kept us safe and prosperous for decades and decades,” she argued.

To recap, Nuland 1) was allegedly involved in a conspiracy to overthrow Ukraine’s president, 2) was definitely behind a strict sanctions regime on Russian officials, and 3) has never softened her uber-hawkish stances since. With U.S.-Russia tensions at their highest point in decades, there should be little doubt as to how her appointment would be received in Moscow.

There is, of course, some reason for hope. In the statement announcing Sherman’s retirement, the Biden administration did not give a clear indication of whether Nuland would be nominated to formally take over as deputy secretary of state. “Biden has asked Victoria Nuland to serve as Acting Deputy Secretary until our next Deputy Secretary is confirmed,” the statement said. This leaves some reason to believe that there is internal opposition to her nomination, or that the administration has someone else in mind.

For now, we can only wait and see as Kyiv struggles to retake territory through its grinding counteroffensive in the east. “In one month, we have only advanced one kilometer and a half,” a Ukrainian medic told Kyiv Post. “We move forward by inches, but I don’t think it’s worth all the human resources and materiel that we have spent.”

Read more here.

AUKUS submerges Canberra sovereignty

By Bryant Harris (edited)

The US House of Representatives on Wednesday advanced a series of authorisations needed to implement the trilateral AUKUS agreement, meant to enable the U.S. nuclear-powered submarine fleet to operate in Australia with UK support.

The House Foreign Affairs Committee unanimously advanced an authorization to sell one or two nuclear-powered Virginia-class submarines to Australia despite consternation from some lawmakers about industry’s capacity to meet production goals. The U.K. and Australia have pushed for a blanket export control exemption, arguing it’s necessary to better facilitate AUKUS cooperation on advanced technologies like artificial intelligence, quantum computing and hypersonic weapons.

The Navy seeks to build two Virginia-class attack submarines and one Columbia-class ballistic submarine per year, though industry is currently only producing approximately 1.2 Virginia-class vessels per year. Under the AUKUS roadmap unveiled in May, Australia will buy at least three and as many as five Virginia-class submarines from the Navy in the 2030s, either newly built or used.

Australia has agreed to invest $3 billion in the U.S. submarine industrial base as part of AUKUS, and seeks private-sector Australian employees to begin training in nuclear-powered submarine work. The top Republican on the Armed Services Committee, Sen. Roger Wicker, R-Miss., is holding up the AUKUS amendments unless Congress injects additional funding into the submarine industrial base. The Senate bill also includes a nonbinding provision calling for additional defense spending beyond the $886 billion top line agreed to in the debt ceiling compromise.

“President Biden should immediately increase U.S. submarine production to 2.5 Virginia-class attack submarines a year,” […] “It is time to make generational investments in U.S. submarine production capacity that include supplier and workforce development initiatives.”

Two other bills advanced by the House Foreign Affairs Committee would give both Britain and Australia a blanket exemption to the International Traffic in Arms Regulations, or ITAR, a privilege currently only enjoyed by Canada. The ITAR exemptions would only apply if the two countries implement their own export control regimes “that are at least comparable to those administered by the United States.”

The State Department and Pentagon oppose exemptions that do not require Australia and the U.K. to first tighten their export control laws. The Senate NDAA also includes a provision that would require a senior Pentagon official to coordinate AUKUS activities within the Defense Department.

Read more here.